-

Study

-

Quick Links

- Open Days & Events

- Real-World Learning

- Unlock Your Potential

- Tuition Fees, Funding & Scholarships

- Real World Learning

-

Undergraduate

- Application Guides

- UCAS Exhibitions

- Extended Degrees

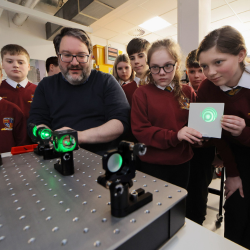

- School & College Outreach

- Information for Parents

-

Postgraduate

- Application Guide

- Postgraduate Research Degrees

- Flexible Learning

- Change Direction

- Register your Interest

-

Student Life

- Students' Union

- The Hub - Student Blog

- Accommodation

- Northumbria Sport

- Support for Students

-

Learning Experience

- Real-World Learning

- Research-enriched learning

- Graduate Futures

- The Business Clinic

- Study Abroad

-

-

International

International

Northumbria’s global footprint touches every continent across the world, through our global partnerships across 17 institutions in 10 countries, to our 277,000 strong alumni community and 150 recruitment partners – we prepare our students for the challenges of tomorrow. Discover more about how to join Northumbria’s global family or our partnerships.

View our Global Footprint-

International Students

- Information for International Students

- Northumbria and your Country

- International Student Events

- Application Guide

- Entry Requirements and Education Country Agents

- Global Offices and Regional Teams

- English Requirements

- English Language Centre

- International student support

- Cost of Living

-

International Fees and Funding

- International Undergraduate Fees

- International Undergraduate Funding

- International Masters Fees

- International Masters Funding

- International Postgraduate Research Fees

- International Postgraduate Research Funding

- Useful Financial Information

-

International Partners

- Agent and Representatives Network

- Global Partnerships

- Global Community

-

International Mobility

- Study Abroad

- Information for Incoming Exchange Students

-

-

Business

Business

The world is changing faster than ever before. The future is there to be won by organisations who find ways to turn today's possibilities into tomorrows competitive edge. In a connected world, collaboration can be the key to success.

More on our Business Services-

Business Quick Links

- Contact Us

- Business Events

- Research and Consultancy

- Education and Training

- Workforce Development Courses

- Join our mailing list

-

Education and Training

- Higher and Degree Apprenticeships

- Continuing Professional Development

- Apprenticeship Fees & Funding

- Apprenticeship FAQs

- How to Develop an Apprentice

- Apprenticeship Vacancies

- Enquire Now

-

Research and Consultancy

- Space

- Energy

- AI Futures

- CHASE: Centre for Health and Social Equity

- NESST

-

-

Research

Research

Northumbria is a research-rich, business-focused, professional university with a global reputation for academic quality. We conduct ground-breaking research that is responsive to the science & technology, health & well being, economic and social and arts & cultural needs for the communities

Discover more about our Research-

Quick Links

- Research Peaks of Excellence

- Academic Departments

- Research Staff

- Postgraduate Research Studentships

- Research Events

-

Research at Northumbria

- Interdisciplinary Research Themes

- Research Impact

- REF

- Partners and Collaborators

-

Support for Researchers

- Research and Innovation Services Staff

- Researcher Development and Training

- Ethics, Integrity, and Trusted Research

- University Library

- Vice Chancellors Fellows

-

Research Degrees

- Postgraduate Research Overview

- Doctoral Training Partnerships and Centres

- Academic Departments

-

Research Culture

- Research Culture

- Research Culture Action Plan

- Concordats and Commitments

-

-

About Us

-

About Northumbria

- Our Strategy

- Our Staff

- Our Schools

- Place and Partnerships

- Leadership & Governance

- University Services

- Northumbria History

- Contact us

- Online Shop

-

-

Alumni

Alumni

Northumbria University is renowned for the calibre of its business-ready graduates. Our alumni network has over 253,000 graduates based in 178 countries worldwide in a range of sectors, our alumni are making a real impact on the world.

Our Alumni - Work For Us

Any Questions?

Our Applicant Services team will be happy to help. They can be contacted on 0191 406 0901 or by using our Contact Form.

All information is accurate at the time of sharing.

Full time Courses are primarily delivered via on-campus face to face learning but could include elements of online learning. Most courses run as planned and as promoted on our website and via our marketing materials, but if there are any substantial changes (as determined by the Competition and Markets Authority) to a course or there is the potential that course may be withdrawn, we will notify all affected applicants as soon as possible with advice and guidance regarding their options. It is also important to be aware that optional modules listed on course pages may be subject to change depending on uptake numbers each year.

Contact time is subject to increase or decrease in line with possible restrictions imposed by the government or the University in the interest of maintaining the health and safety and wellbeing of students, staff, and visitors if this is deemed necessary in future.

Accessibility and Student Inclusion

Northumbria University is committed to developing an inclusive, diverse and accessible campus and wider University community and are determined to ensure that opportunities we provide are open to all.

We are proud to work in partnership with AccessAble to provide Detailed Access Guides to our buildings and facilities across our City, Coach Lane and London Campuses. A Detailed Access Guide lets you know what access will be like when you visit somewhere. It looks at the route you will use getting in and what is available inside. All guides have Accessibility Symbols that give you a quick overview of what is available, and photographs to show you what to expect. The guides are produced by trained surveyors who visit our campuses annually to ensure you have trusted and accurate information.

You can use Northumbria’s AccessAble Guides anytime to check the accessibility of a building or facility and to plan your routes and journeys. Search by location, building or accessibility feature to find the information you need.

We are dedicated to helping students who may require additional support during their student journey and offer 1-1 advice and guidance appropriate to individual requirements. If you feel you may need additional support you can find out more about what we offer here where you can also contact us with any questions you may have:

Social

Upcoming events

Launch of the Northern Interprofessional Education Strategy

Northumbria University

-

Broken Bonds: New Perspectives on Marital Breakdown

The Great Hall

-

.png?modified=20250916102106)